All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Presuming rate of interest rates stay strong, even greater ensured rates could be feasible. Making use of a laddering method, your annuity profile renews every couple of years to optimize liquidity.

MYGA's are the most preferred and one of the most usual. With multi-year accounts, the rate is secured for your selected period. Prices are assured by the insurer and will certainly neither increase neither lower over the selected term. We see interest in short-term annuities providing 2, 3, and 5-year terms.

Annuity Date

Which is best, straightforward rate of interest or worsening passion annuities? Most insurance coverage firms only offer compounding annuity plans.

It all depends on the hidden price of the repaired annuity contract, of program. Experienced dealt with annuity financiers understand their premiums and interest gains are 100% accessible at the end of their selected term.

Unlike CDs, fixed annuity policies enable you to withdraw your passion as earnings for as long as you wish. And annuities offer greater rates of return than almost all equivalent bank tools used today.

There are several extremely rated insurance coverage business striving for down payments. There are several popular and highly-rated business using competitive yields. And there are agencies specializing in ranking annuity insurance policy companies.

These grades go up or down based upon several aspects. Thankfully, insurer are normally safe and safe and secure establishments. Extremely few ever before fall short given that they are not allowed to offer your deposits like financial institutions. There are several ranked at or near A+ providing several of the ideal yields. A couple of that you will certainly see above are Reliance Criterion Life, sister business Midland and North American Life, Americo, Oxford Life, American National, Royal Neighbors, Pacific Guardian Life, Athene, Sagicor, Global Atlantic, and Aspida to call a couple of.

View this short video clip to recognize the resemblances and distinctions between the 2: Our customers purchase repaired annuities for several reasons. Safety and security of principal and ensured interest prices are definitely two of the most crucial aspects.

Do I Have To Pay Taxes On An Inherited Annuity

These plans are really adaptable. You may wish to postpone gains currently for larger payouts during retired life. We give products for all scenarios. We aid those needing prompt passion income currently as well as those planning for future revenue. It is essential to note that if you require earnings currently, annuities function best for those over age 59 1/2.

We are an independent annuity broker agent with over 25 years of experience. We help our clients lock in the greatest returns possible with safe and safe and secure insurance business.

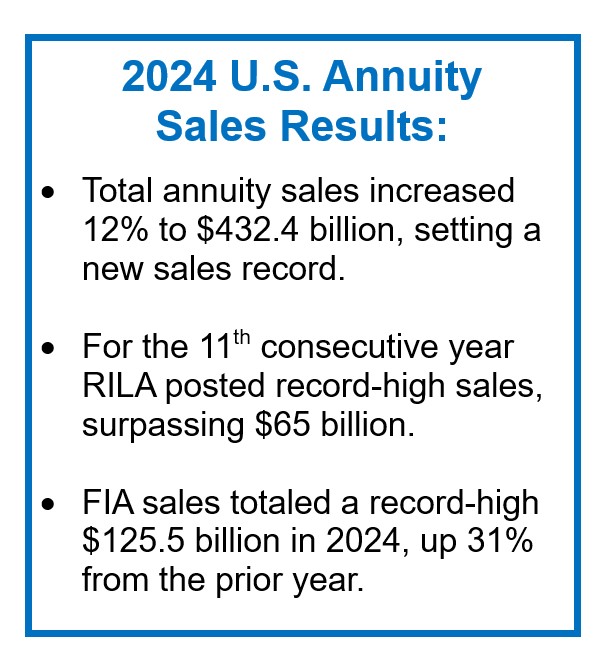

In current years, a wave of retiring baby boomers and high rate of interest have actually assisted gas record-breaking sales in the annuity market. From 2022 to 2024, annuity sales topped $1.1 trillion, according to Limra, an international research study company for the insurance coverage market. In 2023 alone, annuity sales boosted 23 percent over the prior year.

2025 Life Insurance Policies Four-hour Course Curriculum

With more possible rate of interest rate cuts on the perspective, simple set annuities which have a tendency to be less complex than various other options on the market might come to be much less attracting customers as a result of their subsiding prices. In their location, various other varieties, such as index-linked annuities, may see a bump as customers look for to record market growth.

These price walkings offered insurance companies space to use more appealing terms on dealt with and fixed-index annuities. "Interest rates on fixed annuities likewise rose, making them an attractive financial investment," claims Hodgens. Also after the securities market recoiled, netting a 24 percent gain in 2023, remaining anxieties of an economic downturn kept annuities in the limelight.

Various other factors also added to the annuity sales boom, including more financial institutions now supplying the items, states Sheryl J. Moore, CEO of Wink Inc., an insurance marketing research firm. "Consumers are finding out about annuities greater than they would've in the past," she claims. It's likewise much easier to acquire an annuity than it made use of to be.

"Actually, you can obtain an annuity with your representative through an iPad and the annuity is approved after finishing an online type," Moore says. "It made use of to take weeks to obtain an annuity through the issue procedure." Set annuities have propelled the current development in the annuity market, standing for over 40 percent of sales in 2023.

Limra is expecting a pull back in the popularity of repaired annuities in 2025. Sales of fixed-rate deferred annuities are expected to drop 15 percent to 25 percent as rate of interest decline. Still, repaired annuities have not lost their shimmer quite yet and are supplying conventional capitalists an eye-catching return of more than 5 percent for currently.

Tsp Annuity Rate Is 5.075 For March 2025 : R/thriftsavingsplan

Variable annuities often come with a washing checklist of charges mortality expenditures, administrative prices and investment monitoring costs, to name a few. Fixed annuities maintain it lean, making them a less complex, less pricey option.

Annuities are complicated and a bit different from various other monetary items. Find out just how annuity fees and payments work and the common annuity terms that are helpful to know. Fixed-index annuities (FIAs) broke sales documents for the third year in a row in 2024. Sales have virtually doubled since 2021, according to Limra.

Caps can vary based on the insurance provider, and aren't most likely to remain high forever. "As rate of interest have been boiling down recently and are expected to find down better in 2025, we would certainly expect the cap or participation prices to also come down," Hodgens says. Hodgens prepares for FIAs will certainly continue to be eye-catching in 2025, but if you're in the market for a fixed-index annuity, there are a couple of things to keep an eye out for.

So theoretically, these hybrid indices aim to smooth out the low and high of an unstable market, however in reality, they have actually commonly failed for customers. "Much of these indices have actually returned little bit to nothing over the past number of years," Moore states. That's a challenging tablet to ingest, thinking about the S&P 500 published gains of 24 percent in 2023 and 23 percent in 2024.

Variable annuities once dominated the market, however that's changed in a huge means. These items endured their worst sales on document in 2023, going down 17 percent contrasted to 2022, according to Limra.

Annuity Long Term Care Insurance

Unlike fixed annuities, which offer disadvantage defense, or FIAs, which stabilize security with some growth capacity, variable annuities give little to no protection from market loss unless motorcyclists are tacked on at an added price. For capitalists whose leading concern is preserving funding, variable annuities merely do not determine up. These items are additionally infamously complex with a history of high costs and substantial surrender costs.

But when the marketplace fell down, these motorcyclists became liabilities for insurance firms because their guaranteed worths went beyond the annuity account worths. "So insurer repriced their bikers to have less eye-catching attributes for a greater rate," states Moore. While the sector has actually made some initiatives to enhance transparency and minimize costs, the item's past has actually soured several customers and economic experts, that still check out variable annuities with hesitation.

Taxes On Annuity Inheritance

Yet, RILAs use consumers much greater caps than fixed-index annuities. Exactly how can insurer manage to do this? Insurance firms generate income in various other methods off RILAs, typically by paying investors less than what they make on their investments, according to a testimonial by the SEC. While RILAs seem like a large amount what's not to like about greater prospective returns with less fees? it is necessary to recognize what you're authorizing up for if you remain in the market this year.

For example, the wide variety of crediting techniques used by RILAs can make it tough to compare one product to an additional. Higher caps on returns also feature a compromise: You handle some danger of loss beyond a set floor or buffer. This buffer guards your account from the initial part of losses, typically 10 to 20 percent, but afterwards, you'll shed cash.

Latest Posts

Are Annuities Protected From Creditors

Massmutual Annuities Reviews

Can A Trust Own An Annuity